|

|

Post by economyraft on Sept 10, 2013 10:16:17 GMT -6

Macro Economy Meter, a site dedicated to economy and demographic related statistics. The site is rich in graphically presented info.

|

|

|

|

Post by jeffolie on Sept 10, 2013 16:36:52 GMT -6

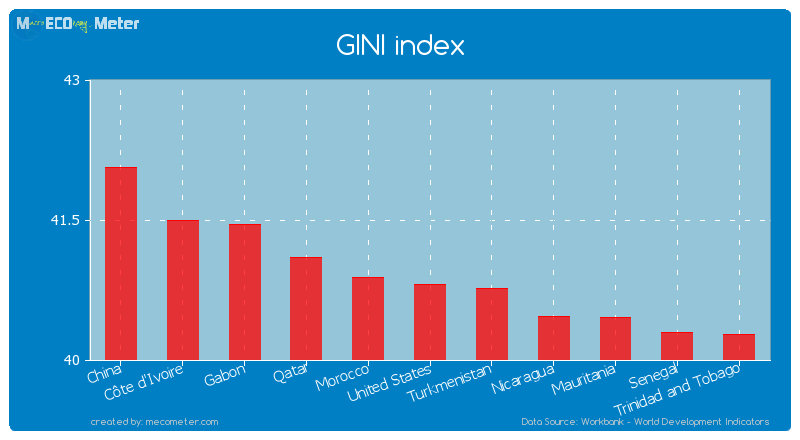

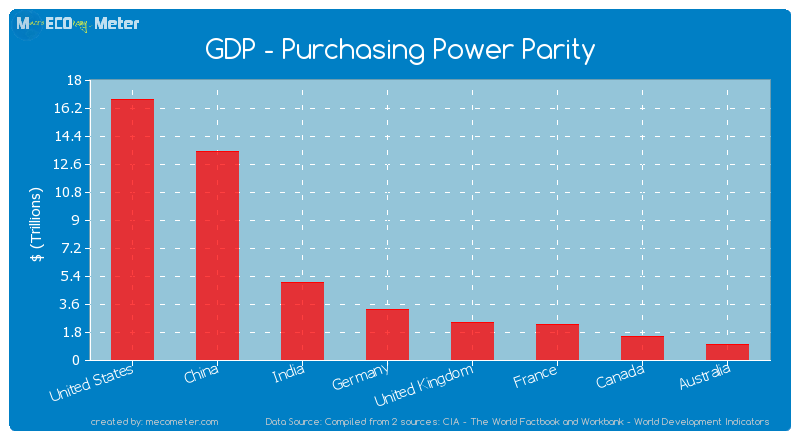

Macro Economy Meter, a site dedicated to economy and demographic related statistics. The site is rich in graphically presented info. Very interesting and with graphs ... for example  mecometer.com/image/barchart-similar-countries/united-states/gini-index-worldbank.png mecometer.com/image/barchart-similar-countries/united-states/gini-index-worldbank.png mecometer.com/image/barchart-similar-countries/united-states/diabetes-prevalence-worldbank.png mecometer.com/image/barchart-similar-countries/united-states/diabetes-prevalence-worldbank.png mecometer.com/image/barchart-top-countries/gdp-ppp.png mecometer.com/image/barchart-top-countries/gdp-ppp.pngMajor world economies by historical values of its GDP - Purchasing Power Parity SummaryThe world's GDP - Purchasing Power Parity is equal to 84,970,000 $ (Millions) The countries with the highest GDP - Purchasing Power Parity are United States, China, India, Japan, Germany with a GDP - Purchasing Power Parity of (15,940,000), (12,610,000), (4,761,000), (4,704,000), (3,250,000) $ (Millions) respectively. The top 5 countries' GDP - Purchasing Power Parity amounts to 48.56% of the world's GDP - Purchasing Power Parity. Hints:•Click on the worldmap above to change the used color scheme •Click on the flag in the table below to view the Key economic indicators of a country •Click on the mini blue chart in the table below to view the details related to GDP - Purchasing Power Parity for a specific country •Click on the green up-arrow to sort a column in ascending order and on the down-arrow to sort the column in descending order. mecometer.com/topic/gdp-ppp/ |

|

|

|

Post by unlawflcombatnt on Sept 22, 2013 0:10:35 GMT -6

Interesting graphs. But the Purchasing Power Index is a concoction invented to imply that countries like China really, really, REALLY can purchase goods from the US. But this is a nonsensical construct. If China buys goods from us, it is dependent on the USD value of their purchasing power, not some fraudulently concocted purchasing power index. According to CIA statistics, China's USD-valued GDP is $8.227 trillion--roughly 1/2 that of the U.S. Meanwhile, their population is 1.35 billion--roughly 4.3x as many as the US's 310 million. With a USD-valued GDP of roughly 1/2 that of the US, spread out over 4.3x as many people, that gives the average Chinese consumer less than 1/8th the spending power of the average American consumer. China does NOT have the potential to be a major market for American exports, despite all the bizarre concoctions that American Economic fiction writers dream up. www.cia.gov/library/publications/the-world-factbook/geos/ch.html |

|

|

|

Post by jeffolie on Sept 22, 2013 8:20:01 GMT -6

Interesting graphs. But the Purchasing Power Index is a concoction invented to imply that countries like China really, really, REALLY can purchase goods from the US. But this is a nonsensical construct. If China buys goods from us, it is dependent on the USD value of their purchasing power, not some fraudulently concocted purchasing power index. According to CIA statistics, China's USD-valued GDP is $8.227 trillion--roughly 1/2 that of the U.S. Meanwhile, their population is 1.35 billion--roughly 4.3x as many as the US's 310 million. With a USD-valued GDP of roughly 1/2 that of the US, spread out over 4.3x as many people, that gives the average Chinese consumer less than 1/8th the spending power of the average American consumer. China does NOT have the potential to be a major market for American exports, despite all the bizarre concoctions that American Economic fiction writers dream up. www.cia.gov/library/publications/the-world-factbook/geos/ch.htmlI agree. The vast poor, poverty incomes in India, China, Brazil, etc result in their lack of purchasing power. Even so, niche markets exist among the upper incomes of these huge populations to the point that selective exporters thrive in niche markets such as luxury items, military sales, bulk commodity grain sales, investment vehicles, financial services such as corporate level insurance. Some 2 way trade does exist. These at times are labeled 'emerging markets' in part because when times are good, these placed emerge as temporarily thriving places for US sellers to do business ... when times suffer, the emerging markets again regain their poor reputations as places for US sellers. |

|