|

|

Post by jeffolie on Nov 3, 2014 17:32:27 GMT -6

|

|

|

|

Post by unlawflcombatnt on Jan 18, 2015 14:47:20 GMT -6

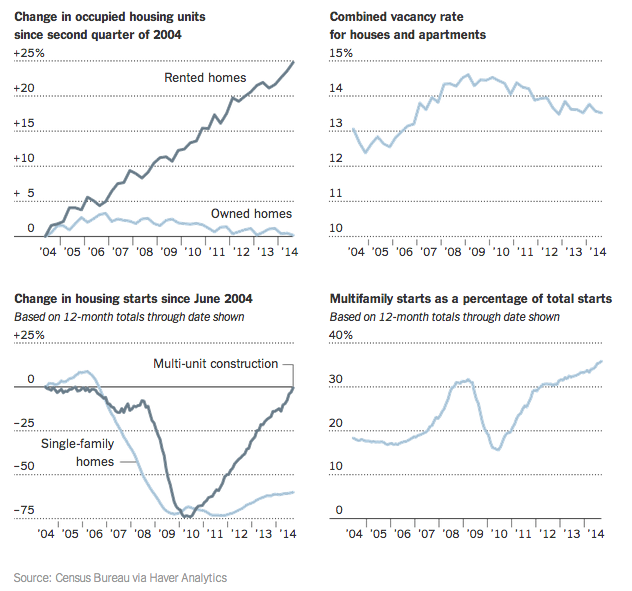

The top left chart is the most interesting ('Change in occupied housing units...') ___________________ Assuming the chart is correct, it indicates that ALL of the increase in home occupancy over the last decade has been from renter-occupancy, not owner-occupancy. It suggests that there's little or no increase in the number of individuals actually owning homes. Rather, it indicates an almost fixed number of people now own more homes. In other words, the "rise" in home ownership has come from more homes being "owned" by the same number of people. That's a perfect match for the rise in wealth & income inequality. The rich have simply bought more homes--and then rented them out. |

|

|

|

Post by spudbuddy on May 3, 2015 14:01:52 GMT -6

Which represents the transfer of wealth.

Is not the vast majority of assets actually accumulated by the middle class based on the property they own?

So a rentier class commands control over this asset, and rents it back out for profit.

Many of those who used to own, now rent.

And many more who would have owned....still rent.

There's a curious thing going on here in my little town.

I live in a neighborhood where clusters of working class people rent as a matter of course.

Most of them are not financially upwardly mobile, and probably never will be.

This has repercussions not so much in what they live in - but what they drive.

I've never seen so many late model cars. They're everywhere. Mega-clusters of them.

Most being paid for in 6, 7, 8 or more year repayment plans.

The car payment has kind of become the "new mortgage", as it were.

A year or so ago, I attempted to try investigating and researching the Blackstone Group.

So far I've found precious little real information on them - beyond what sprung out in

the national consciousness 2 or 3 years ago.

The men in black toting briefcases full of cash, buying up much of the collateral damage

and flying debris and settling dust resulting from the blowup of the housing crash.

That particulaar "ground zero" brought down far more than two tall buildings.

Wandering through various public forums, reading the discontent and frutstration of Blackstone

renters, it became quickly apparent what had transpired.

But what became of the Rental Derivative adventures on Wall Street?

(a sordid attempt to create new exotic financial returns based on rent, not mortgages)

|

|