Bubble: San Francisco windfalls to existing property owners

May 2, 2015 5:13:52 GMT -6

unlawflcombatnt likes this

Post by jeffolie on May 2, 2015 5:13:52 GMT -6

A Hill Street Blues Financial World——-Be Careful, Its Dangerous Out There

by David Stockman • May 1, 2015

(portion of text)....

So what the Fed is doing is simply further inflating the financial bubble on the self-serving theory that asset inflation doesn’t count. Well, it seems only yesterday that the Fed’s “maximum employment” objective was bushwhacked by the 2008 bubble meltdown on Wall Street and the Great Recession which followed.

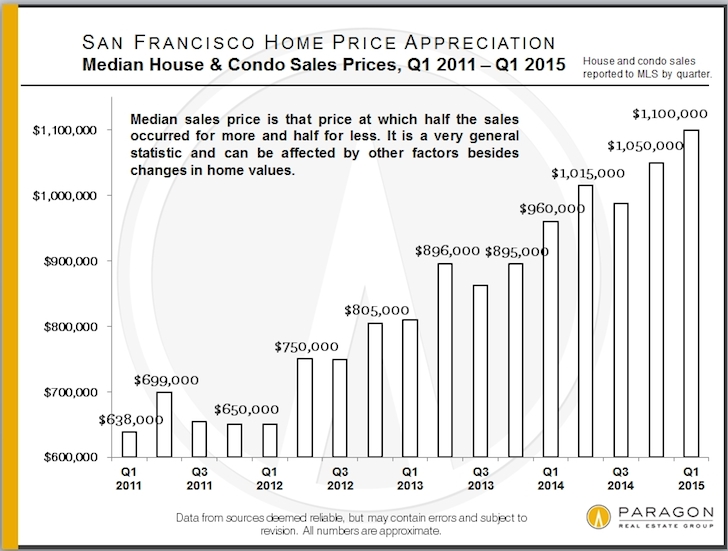

Yet the inhabitants of the Eccles Building stubbornly insist that there are no worrisome bubbles yet evident. Well, here’s one from Janet Yellen’s own backyard courtesy of Dr. Housing Bubble. The median house price in San Francisco is now $1.1 million, and it has been stair-stepping higher like clockwork during each of the Fed’s QE money printing phases.

Indeed, if you had been idling your time in a median priced condo in San Francisco for the past 48 months you could have cashed out this winter at a 72% gain. That’s a $462,000 profit for standing around the basket during the Fed’s monumental money printing campaign.

And yet this is about much more than windfalls to existing property owners who have been smart enough to sell before the next crash. The insane appreciation shown below is only symptomatic of what is happening in the entire US economy.

That is to say, for every instance of windfall gains there are associated disruptions, deformations and malinvestments that reduce societal equity today and generate dead-weight economic losses tomorrow. Tens of thousands of working income families have been flushed out of San Francisco for no good reason; they just can’t afford the soaring rents. Likewise, its commercial landscape is teeming was “cash burn” startups that in due course will vacate their posh office suites and leave busted leases behind when the VC cash dries up.

That’s what bubbles do, and San Francisco has proved that more than once in the present era of central bank driven financial inflation.

SF-property-prices

www.doctorhousingbubble.com/wp-content/uploads/2015/04/SF-property-prices.jpg

There is no mystery, of course, as to where the buying power that propelled this price explosion came from. San Francisco is ground zero for the social media and biotech bubbles.

The cascades of cash which have tumbled out of these bubbles are mind-boggling. The billions of venture capital flowing into these sectors support booming start-up payrolls, mushrooming networks of vendor support services and prodigious on-line advertising outlays. The latter generate more of the same in the next tier of startups which burn the advertising revenues that were funded by their “advertising customers” VC cash. And when this pipeline of start-ups is eventually pushed into the delirious IPO markets, the brokerage accounts of the selling entrepreneurs are suddenly flush with cash and stock—-all the better to collateralize jumbo loans to buy condos, townhouses and lofts and renovate them in style.

Needless to say, this is not capitalist creation at work—–even though venture capital risk-taking and homeruns for inventors and innovators are the sum and substance of real prosperity and growth. What is wrong here is not the process or even some of the outcomes likes Apple and Google.

The evil lies in the context in which today’s venture capitalism is being played out. Namely, an artificial financial casino fostered by central bank falsification of prices and valuations—a milieu where blind greed and mindless start-up activity run wild without the disciplining forces of honest and free capital markets.

There could be no better illustration of this deformation than the flaming valuation mania in the biotech sector. Yes, there are plenty of interesting breakthroughs happening in the biotech world these days, but that has been true for more than a decade. It does not begin to explain how the biotech index soared by 6X since the March 2009 bottom and by nearly 300% just in the last 48 months depicted in the housing graph above.

Here’s actually why. At its peak a few weeks ago, the NASDAQ biotech index of 150 companies was valued at nearly $1.1 trillion. Yet the LTM net income of the entire group was only $21 billion, meaning that the index was trading at 50X profits.

And that wasn’t the half of it. Among these 150 biotechs there were just 25 companies that had any profits at all. This latter group included big cap giants like Gilead, Amgen, Shire, Biogen, Celgene and 20 others, which among them had $30.5 billion of net income and accounted for $780 billion of the total index market cap. At the implied PE multiple of 26X, even these profitable companies were valued at pretty sporty levels.

But there’s no denying the bubble mania when it comes to the remaining 125 companies in the index. These companies were valued at $280 billion, but posted aggregate losses of nearly $10 billion in the most recent LTM reporting period.

So, yes, there is a stupendous bubble in biotech.

.....

davidstockmanscontracorner.com/a-hill-street-blues-financial-world-be-careful-its-dangerous-out-there/?utm_source=wysija&utm_medium=email&utm_campaign=Mailing+List+Mid+Day+Friday

by David Stockman • May 1, 2015

(portion of text)....

So what the Fed is doing is simply further inflating the financial bubble on the self-serving theory that asset inflation doesn’t count. Well, it seems only yesterday that the Fed’s “maximum employment” objective was bushwhacked by the 2008 bubble meltdown on Wall Street and the Great Recession which followed.

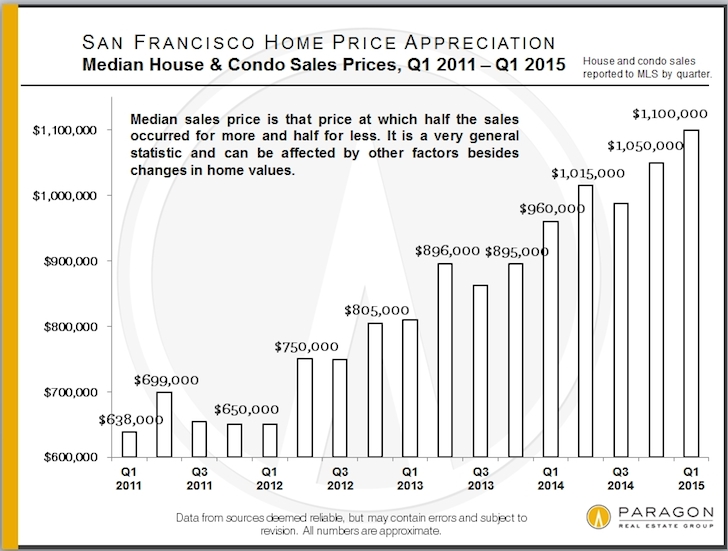

Yet the inhabitants of the Eccles Building stubbornly insist that there are no worrisome bubbles yet evident. Well, here’s one from Janet Yellen’s own backyard courtesy of Dr. Housing Bubble. The median house price in San Francisco is now $1.1 million, and it has been stair-stepping higher like clockwork during each of the Fed’s QE money printing phases.

Indeed, if you had been idling your time in a median priced condo in San Francisco for the past 48 months you could have cashed out this winter at a 72% gain. That’s a $462,000 profit for standing around the basket during the Fed’s monumental money printing campaign.

And yet this is about much more than windfalls to existing property owners who have been smart enough to sell before the next crash. The insane appreciation shown below is only symptomatic of what is happening in the entire US economy.

That is to say, for every instance of windfall gains there are associated disruptions, deformations and malinvestments that reduce societal equity today and generate dead-weight economic losses tomorrow. Tens of thousands of working income families have been flushed out of San Francisco for no good reason; they just can’t afford the soaring rents. Likewise, its commercial landscape is teeming was “cash burn” startups that in due course will vacate their posh office suites and leave busted leases behind when the VC cash dries up.

That’s what bubbles do, and San Francisco has proved that more than once in the present era of central bank driven financial inflation.

SF-property-prices

www.doctorhousingbubble.com/wp-content/uploads/2015/04/SF-property-prices.jpg

There is no mystery, of course, as to where the buying power that propelled this price explosion came from. San Francisco is ground zero for the social media and biotech bubbles.

The cascades of cash which have tumbled out of these bubbles are mind-boggling. The billions of venture capital flowing into these sectors support booming start-up payrolls, mushrooming networks of vendor support services and prodigious on-line advertising outlays. The latter generate more of the same in the next tier of startups which burn the advertising revenues that were funded by their “advertising customers” VC cash. And when this pipeline of start-ups is eventually pushed into the delirious IPO markets, the brokerage accounts of the selling entrepreneurs are suddenly flush with cash and stock—-all the better to collateralize jumbo loans to buy condos, townhouses and lofts and renovate them in style.

Needless to say, this is not capitalist creation at work—–even though venture capital risk-taking and homeruns for inventors and innovators are the sum and substance of real prosperity and growth. What is wrong here is not the process or even some of the outcomes likes Apple and Google.

The evil lies in the context in which today’s venture capitalism is being played out. Namely, an artificial financial casino fostered by central bank falsification of prices and valuations—a milieu where blind greed and mindless start-up activity run wild without the disciplining forces of honest and free capital markets.

There could be no better illustration of this deformation than the flaming valuation mania in the biotech sector. Yes, there are plenty of interesting breakthroughs happening in the biotech world these days, but that has been true for more than a decade. It does not begin to explain how the biotech index soared by 6X since the March 2009 bottom and by nearly 300% just in the last 48 months depicted in the housing graph above.

Here’s actually why. At its peak a few weeks ago, the NASDAQ biotech index of 150 companies was valued at nearly $1.1 trillion. Yet the LTM net income of the entire group was only $21 billion, meaning that the index was trading at 50X profits.

And that wasn’t the half of it. Among these 150 biotechs there were just 25 companies that had any profits at all. This latter group included big cap giants like Gilead, Amgen, Shire, Biogen, Celgene and 20 others, which among them had $30.5 billion of net income and accounted for $780 billion of the total index market cap. At the implied PE multiple of 26X, even these profitable companies were valued at pretty sporty levels.

But there’s no denying the bubble mania when it comes to the remaining 125 companies in the index. These companies were valued at $280 billion, but posted aggregate losses of nearly $10 billion in the most recent LTM reporting period.

So, yes, there is a stupendous bubble in biotech.

.....

davidstockmanscontracorner.com/a-hill-street-blues-financial-world-be-careful-its-dangerous-out-there/?utm_source=wysija&utm_medium=email&utm_campaign=Mailing+List+Mid+Day+Friday